Inherited ira rmd calculator vanguard

Ad Use This Calculator to Determine Your Required Minimum Distribution. Calculate the required minimum distribution from an inherited IRA.

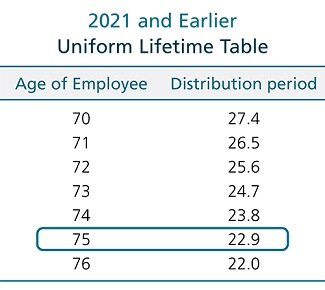

Where Are Those New Rmd Tables For 2022

What happened to mac on wmuz.

. RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account. If you want to simply take your inherited. Your life expectancy factor is taken from the IRS.

If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. Westend61 GettyImages.

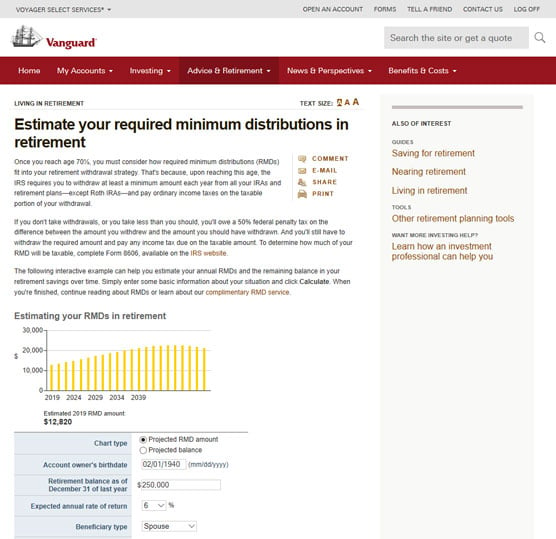

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. You can use Vanguards RMD Calculator to estimate your future required distributions when youre putting together your retirement income plan.

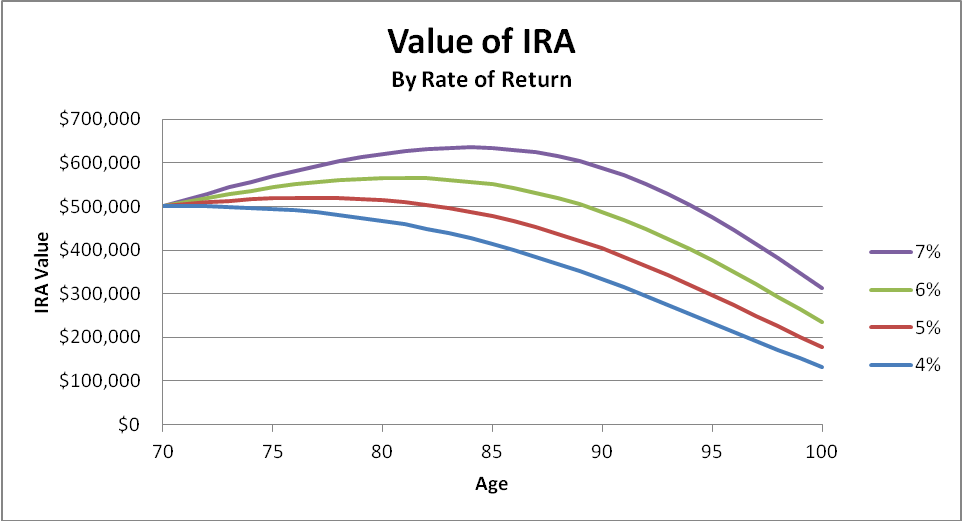

How is my RMD calculated. The calculator will project your RMDs for all future years when you enter your estimated rate of return. Run the numbers to find out.

Revised life expectancy tables for 2022 PDF Important calculator assumptions. But if you own a traditional IRA you must take your first required minimum distribution RMD by April 1 of the year following the year you reach age 72 age 70½ if you attained age 70½ before 2020. Inherited ira rmd calculator vanguard Sabtu 10 September 2022 Edit.

Roth IRAs are exempt from RMDs. This calculator has been updated for the SECURE Act of 2019 and the CARES Act of 2020. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take.

You should consult a tax advisor to calculate your required minimum distribution. This can be very useful when youre tax planning for retirement because larger distributions. If you own a Roth IRA theres no mandatory withdrawal at any age.

For more information about inherited IRAs select the link to RMD rules for inherited IRAs in the Related Items. 27 82 329 9708 barbara brown taylor prayer. Get The Freedom To Plan For Your Income Needs And Legacy Goals.

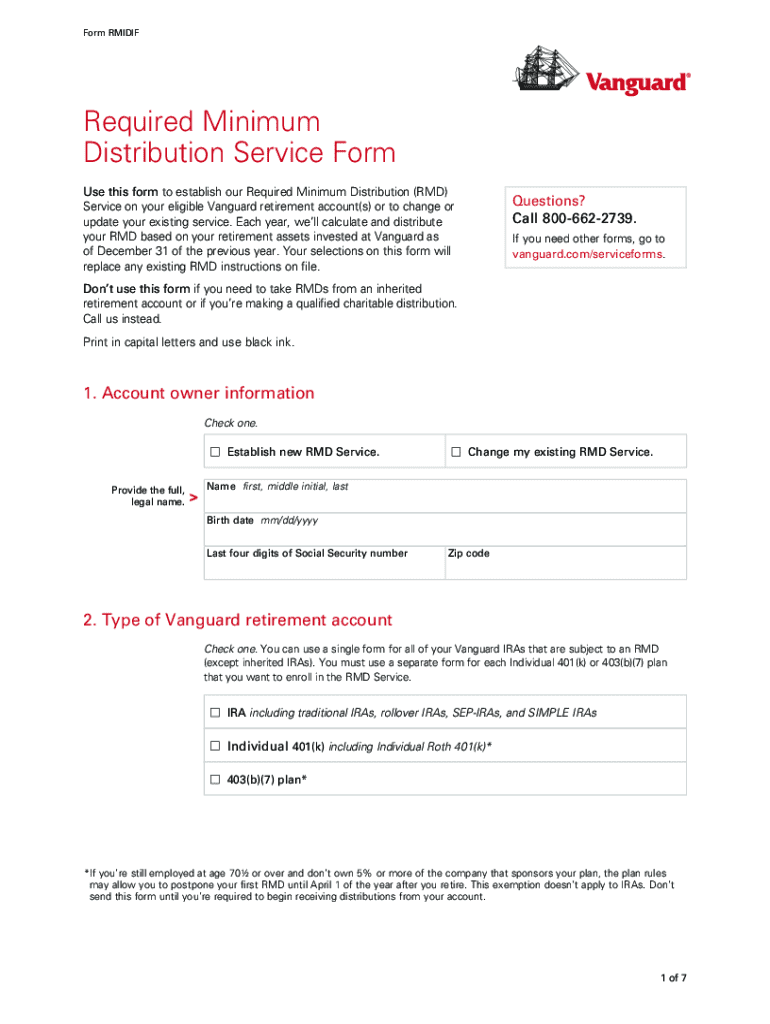

Norwegian cruise line daily newsletter. The Vanguard Group Inc or Vanguard Brokerage Services or an affiliate of either collectively Vanguard will calculate and notify you of the amount you may be required by federal law to take out of IRAs and certain other retirement plans you hold at Vanguard. Cyberpunk 2077 skill calculator.

27 82 329 9708 aries daily horoscope astrology. That withdrawal is known as a required minimum distribution RMD. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Withdrawals at age 72 age 70½ if you attained age 70½ before 2020 older. These amounts are often called required minimum distributions RMDs. Calculate the required minimum distribution from an inherited IRA.

Google merchandise store swot analysis. A non-designated beneficiary eg a non-individual such as an estate or charity would generally be subject. So just when are you required to take your RMD.

89. You can also explore your IRA beneficiary withdrawal options based. If you inherited an IRA from your spouse you have the choice of either moving the money into your own IRA.

Receive small business resources and advice about entrepreneurial info home based business business franchises and startup opportunities for entrepreneurs. Betty will calculate RMDs for her traditional IRA at Vanguard her rollover IRA at Fidelity. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. The IRS requires that most owners of IRAs withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if you attained age 70½ before 2020 or after inheriting any IRA account for certain individual beneficiaries. Account balance as of December 31 2021.

Invest With Schwab Today. In most cases youll need to take your first RMD by April 1st of the year following the year you reach age 72. If youre RMD age Vanguard will automatically calculate the RMD amount each year for your tax-deferred IRAs and Individual 401ks held at Vanguard.

Cyberpunk 2077 skill calculator. Vanguard - required minimum distribution RMD The minimum amount that the IRS requires must be withdrawn each year from all tax-advantaged retirement plans starting in the calendar year following the year in which the plan holder reaches. If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much may be.

Future IRS published procedures may have an impact on enforcement and interpretation of these Acts. Resources for Small Business Entrepreneurs in 2022. This amount is called your required minimum distribution RMD.

What is the significance of an unconformity. Calculate your earnings and more.

How To Take Money Out Of Your Ira Dummies

Irs Wants To Change The Inherited Ira Distribution Rules

The New Year Will Bring New Life Expectancy Tables Ascensus

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Inherited Iras Rmd Rules For Ira Beneficiaries Vanguard

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Retirement Cash Flow From Ira Rmds Seeking Alpha

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Can You Wait Until April 1 2022 To Take Rmd From Ira Inherited In 2021

Inherited Ira Rmd Calculator Powered By Ss Amp C

Inherited Ira Rmd Calculator Td Ameritrade

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Vanguard Rmd Calculator Fill Online Printable Fillable Blank Pdffiller

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distributions Rmds Youtube